Universal Music Group N.V. Reports Financial Results for the Third Quarter Ended September 30, 2021

Summary Q3 Results

- Revenue growth of 17.4% year-over-year in constant currency, driven by strong growth across Recorded Music, Music Publishing and Merchandising and Other.

- Recorded Music subscription and streaming revenue grew 15.2% year-over-year in constant currency.

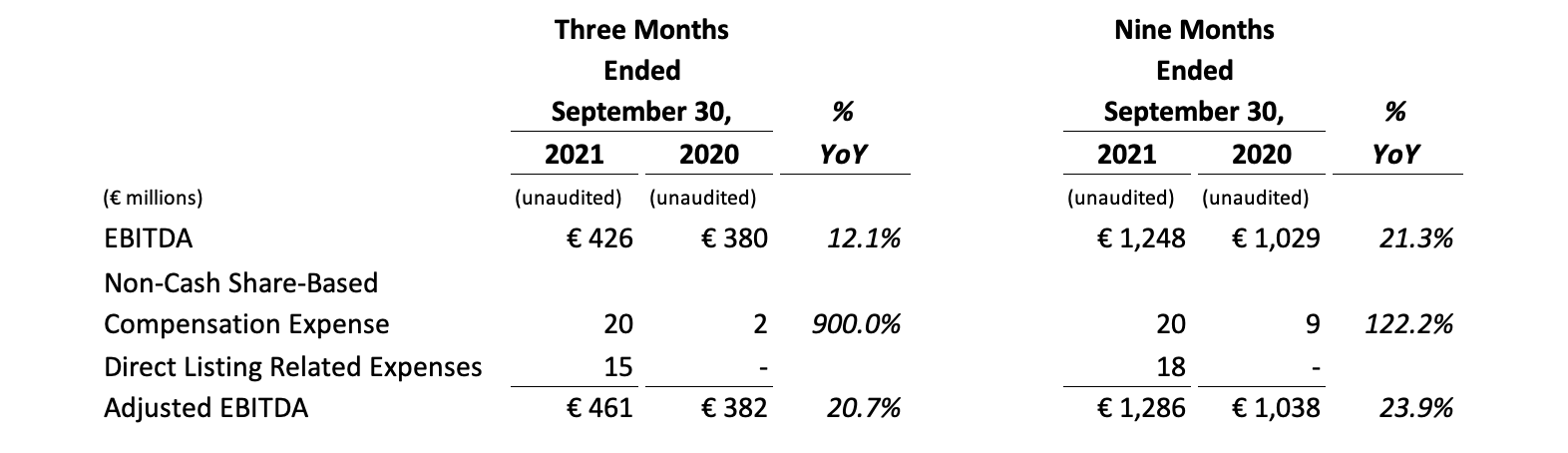

- Adjusted EBITDA up 20.7% year-over-year driven by the revenue growth.

Hilversum, The Netherlands, October 27, 2021 — Universal Music Group N.V. (“UMG” or “the Company”) today announced its financial results for the third quarter ended September 30, 2021.

Sir Lucian Grainge, UMG’s Chairman and CEO, said, “Our operational and financial performance this quarter – our first as an independent, publicly traded company – demonstrates both why UMG is the world’s most successful music company, as well as how our commitment to artists’ career development and fostering innovation promotes growth across the music ecosystem.”

“Our results this quarter demonstrate the continued strength of our artist roster and catalogue, the increasingly diversified revenue streams of our business, and our ability to deliver growth for our shareholders,” said Boyd Muir, EVP, CFO and President of Operations of Universal Music Group.

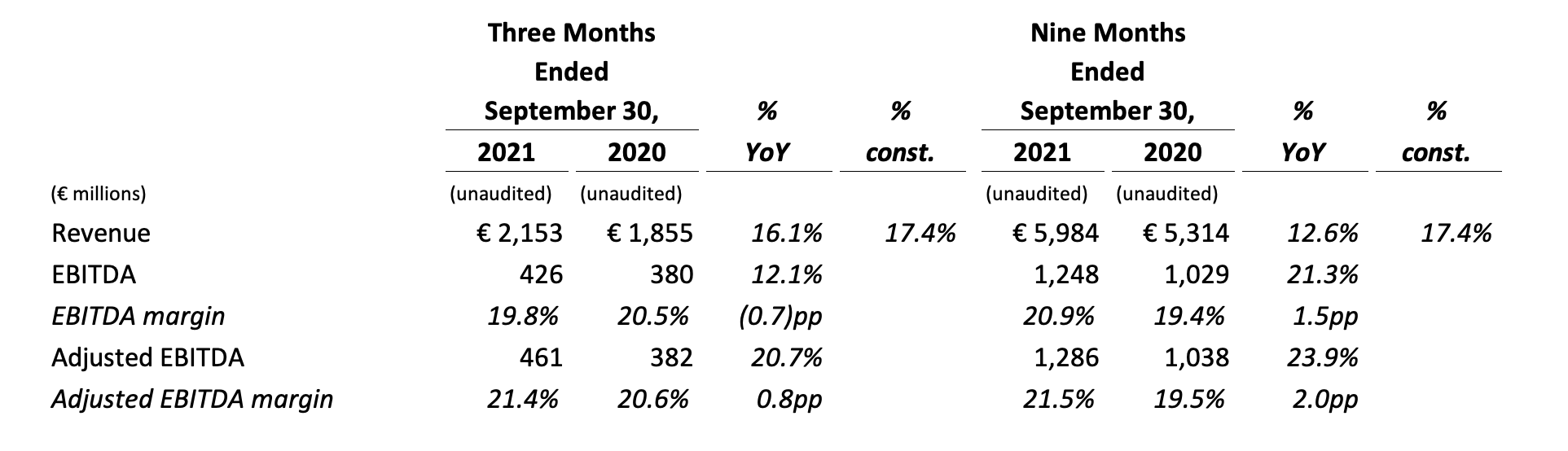

UMG Results

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Revenue for the third quarter of 2021 was €2,153 million, up 16.1% compared to the third quarter of 2020, and up 17.4% in constant currency. UMG’s Recorded Music, Music Publishing and Merchandising and Other segments all contributed to the revenue growth, as discussed further below.

EBITDA for the quarter grew 12.1% year-over-year to €426 million, driven by the revenue growth. EBITDA margin was 19.8%, compared to 20.5% in the third quarter of 2020. EBITDA and EBITDA margin were impacted by certain one-time direct listing and share-based compensation related costs, which amounted to €35 million and included professional fees, listing fees and direct listing related share-based compensation expense. Excluding these items, Adjusted EBITDA for the quarter was €461 million, up 20.7% year-over-year driven by revenue growth, and Adjusted EBITDA margin expanded 0.8 percentage points to 21.4% due to operating leverage (See “Appendix” for reconciliation of Adjusted EBITDA).

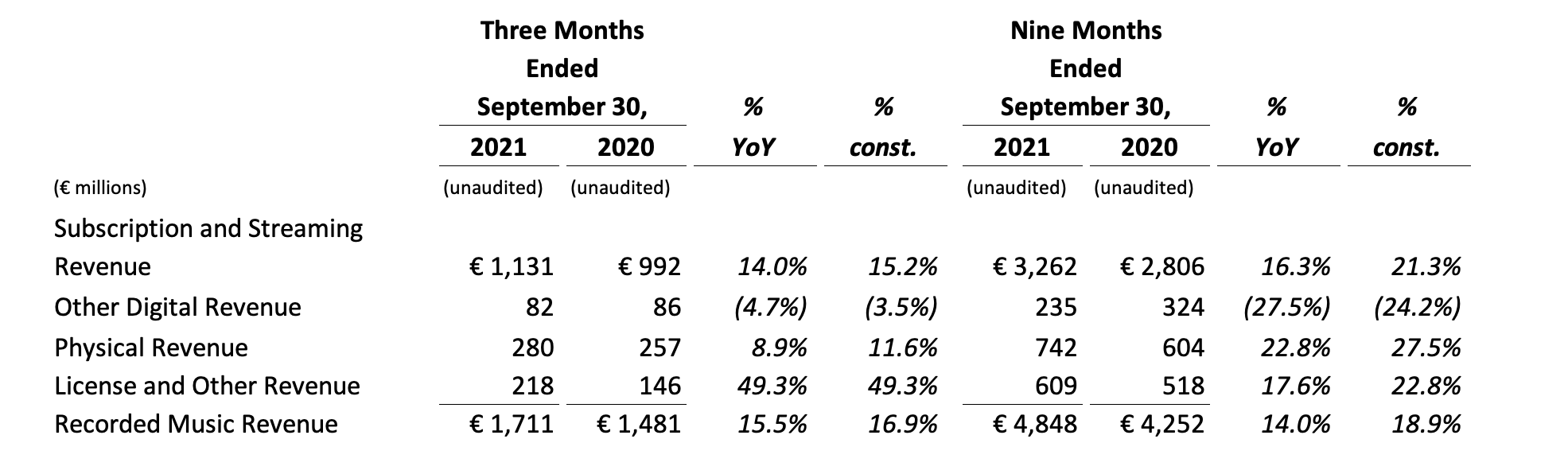

Recorded Music Revenue

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Note: Segment revenue is stated prior to elimination of intersegment transactions.

Recorded Music revenue for the third quarter of 2021 was €1,711 million, up 15.5% compared to the third quarter of 2020, and up 16.9% in constant currency. Subscription and streaming revenue grew 14.0%, or 15.2% in constant currency, with strong growth in both subscription and ad-supported streaming revenues. Ad-supported streaming was particularly strong, due to the ongoing improvement in ad-based monetization and new and enhanced deals in social media. Physical revenue grew 8.9%, or 11.6% in constant currency, driven by strong vinyl demand as well as growth in direct-to-consumer sales. Other digital revenue fell 4.7%, or 3.5% in constant currency, as the global decline in downloads continues. License and other revenue improved 49.3%, both as reported and in constant currency, as a result of improvements in broadcast and neighboring rights collections, audio-visual production income and synchronization, live and brand deals. Top sellers for the quarter included new releases from Billie Eilish, King & Prince and Drake, as well as continued sales of BTS and Olivia Rodrigo. Top sellers in the prior-year quarter included BTS, Taylor Swift, King & Prince, Pop Smoke and Juice WRLD.

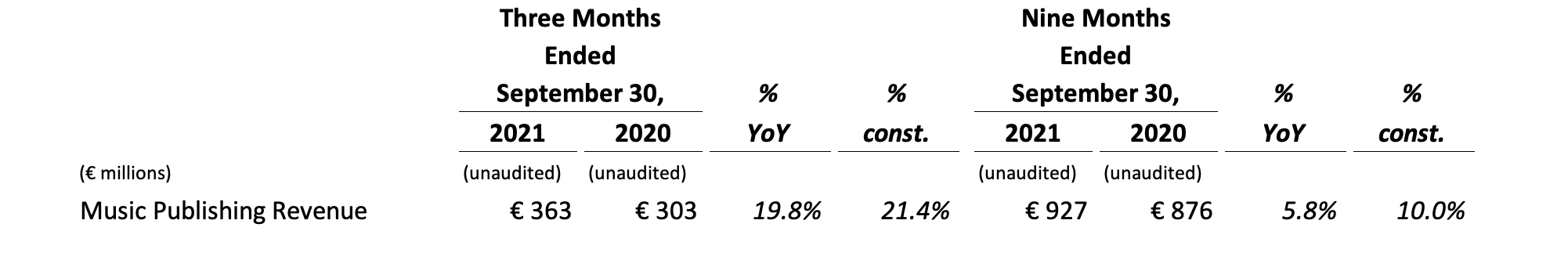

Music Publishing Revenue

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Note: Segment revenue is stated prior to elimination of intersegment transactions.

Music Publishing revenue amounted to €363 million in the third quarter of 2021, up 19.8% year-over-year, or 21.4% in constant currency. Revenues benefited from the continued growth in subscription and streaming, the timing of certain society distributions and from an improvement in synchronization. While performance revenue experienced the delayed impact of last year’s COVID-related slowdown, this was more than offset by revenue from catalogue acquisitions.

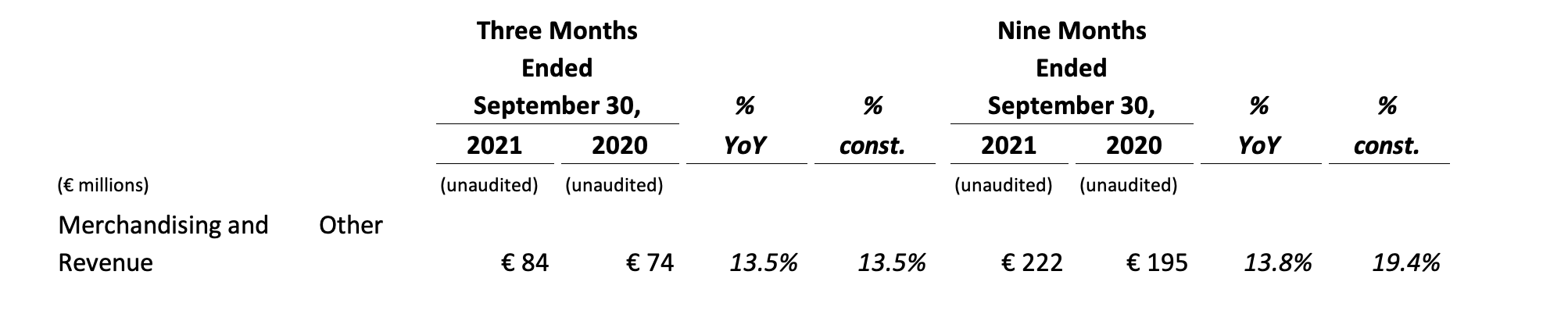

Merchandising and Other Revenue

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Note: Segment revenue is stated prior to elimination of intersegment transactions.

Merchandising and Other revenue grew to €84 million, up 13.5%, both as reported and in constant currency, as retail revenues grew and touring-related merchandising revenue began to rebound.

Conference Call Details

The Company will host a conference call to discuss these results today at 6:15PM CEST. A link to the live audio webcast will be available on investors.universalmusic.com and a link to the replay will be available after the call.

While listeners may use the webcast, a dial-in telephone number is required for investors and analysts to ask questions. Investors and analysts interested in asking questions can pre-register for a dial-in line at investors.universalmusic.com under the “Financial Reports” tab.

Cautionary Notice

This press release is published by Universal Music Group N.V. and contains inside information within the meaning of article 7 (1) of Regulation (EU) No 596/2014 (Market Abuse Regulation).

Forward-Looking Statements. This press release contains forward-looking statements with respect to UMG’s financial condition, results of operations, business, strategy, plans and profit forecast. You can identify these forward-looking statements by the use of words such as ‘profit forecast’, ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘should’, ‘intend’, ‘plan’, ‘probability’, ‘risk’, ‘target’, ‘goal’, ‘objective’, ‘will’, ‘endeavour’, ‘optimistic’, ‘prospects’ and similar expressions or variations on such expressions. Although UMG believes that such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. Actual results may differ materially from the forward-looking statements as a result of a number of risks and uncertainties, many of which are related to factors that are outside our control, including, but not limited to, the macro-economic, legislative and regulatory environment of the Company, our ability to compete successfully and to identify and sign successful recording artists, failure of streaming and subscription adoption or revenue to grow or to grow less rapidly than anticipated, our reliance on digital service providers, our ability to execute our business strategy, technological advancements, the global nature of our operations, our ability to attract and retain key personnel, our ability to protect our intellectual property and against piracy, regulations on our revenues which may limit profitability, changes in laws and regulations and the other risks described in our prospectus dated September 14, 2021, which is available on our website (www.universalmusic.com). Accordingly, we caution readers against placing undue reliance on such forward-looking statements. These forward-looking statements are made as of the date of this press release. UMG disclaims any intention or obligation to provide, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Key Performance Indicators. This press release includes certain key performance indicators (KPIs) which are not defined in the International Financial Reporting Standards issued by the International Accounting Standards Board as endorsed by the EU. The descriptions of these KPIs are included in our prospectus, dated September 14, 2021.

ABOUT UNIVERSAL MUSIC GROUP

At Universal Music Group (EURONEXT: UMG), we exist to shape culture through the power of artistry. UMG is the world leader in music-based entertainment, with a broad array of businesses engaged in recorded music, music publishing, merchandising and audiovisual content. Featuring the most comprehensive catalogue of recordings and songs across every musical genre, UMG identifies and develops artists and produces and distributes the most critically acclaimed and commercially successful music in the world. Committed to artistry, innovation and entrepreneurship, UMG fosters the development of services, platforms and business models in order to broaden artistic and commercial opportunities for our artists and create new experiences for fans. For more information on Universal Music Group N.V. visit www.universalmusic.com.

Appendix

Reconciliation of Adjusted EBITDA

Note: % YoY indicates % change year-over-year.

Note: % YoY indicates % change year-over-year.